Here is the recording for Office Hours from August 25, 2020.

Silver Club members, please log in to view the recording

by Kristina

Here is the recording for Office Hours from August 25, 2020.

Silver Club members, please log in to view the recording

Here is the recording for Office Hours today. You can find the following wine accounting & QuickBooks topics in this month’s recording:

Silver Club members, please log in to view the recording

Here is the recording for Office Hours today. You can find the following wine accounting & QuickBooks topics in this month’s recording:

Silver Club members, please log in to view the recording

by Jeanette

It’s spring and you should have finished closing your QuickBooks file for last year. Therefore, now is a great time to do some Spring Cleaning! This means it is time to check out the health of the file.

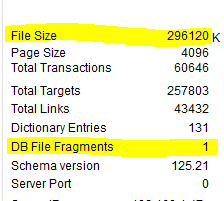

Open QuickBooks and hit the “F2” key to see the Product Information window.

File Size: When the file gets too large, it will run slowly. Reports will take a long time to load and new transactions will take a long time to save. This is super frustrating because we all have a hundred things to do at any given time; however, a file with data damage can be very expensive to repair. If you push-in the sales receipts from the POS program, you will reach the maximum file size limit much faster than a winery that does the summary method. If you hit that maximum file size limit, or if you notice that the program becomes sluggish, then it is time to condense the file. Intuit suggests these maximum limits:

Pro/Premier – 400 MB (that’s 400,000 K)

Enterprise – 1.0 to 1.5 G (that’s 1,000 to 1,500 MB)

If the file in the example above was Pro/Premier, then with 300,000K, they are still looking good. In this situation, you should check again in approximately six months to review how the file grew during the six-month timeframe.

DB File Fragments: By design, Microsoft writes bits and pieces of the files throughout the hard drive. This is why you should “de-frag” your hard drive on a regular basis so that you can put the pieces of the files back together. The “DB File Fragments” tell you how many pieces your QuickBooks file is broken up into. This number should be no higher than 10. Too many fragments can create data damage. You want to avoid that scenario at all costs because repairing data damage is both painful and expensive.

File Verification: You should be running the QuickBooks backup with Full Verification on a regular basis. Do not rely on the cloud backup that you also have in place, therefore this step is not part of the Spring Cleaning routine. The file verification will tell you if you have any errors. Let’s assume you are doing this at least weekly – are you getting a regular message to Rebuild the file? If so, double-check the DB File Fragments and File Size. If that doesn’t fix the problem, then give your friendly ProAdvisor a call.

READ THIS FIRST: Before you condense, you must clear up all of the errors. The condense will not fix errors and it can make some errors worse. Therefore, first fix the file fragments, then do the condense. As a side note, before you upgrade the file to the newest version, complete these steps and fix all of your errors first. The upgrade will not fix errors either.

To fix the file fragments, you do what we call the Portable File Round-Trip:

Make a Portable file (File -> Create Copy -> Portable Company File).

Restore that file and give it a new name. I typically change the “tail” of the file name instead of changing the whole filename.

Do this 2 more times.

You will do 3 round-trips; this should reduce your file fragments to one, as in the example above.

If you need to condense, read on….

If you have QB 2019 or newer, Intuit added a new condense feature that deletes the Audit Trail. This can reduce the file as much as 30%. Murph (one of us ProAdvisors’ favorite go-to tech guy for all things QuickBooks), typically doesn’t like the QB condense feature, but he really likes this new option.

Step 1 – Make a backup with full verification.

Step 2 – Pull a current trial balance. You will use this to compare the file after the condense.

Step 3 – Condense by deleting the Audit Trail. (File -> Utilities -> Condense File) Make a backup before you start, and store this is a safe place because you never know if you will need this information.

Step 4 – If you want to make the file even smaller, use the second step of the condense to remove selected transactions. The usual choice is “transactions before …” then pick a date. In the next window, you have 3 choices about how to handle the transactions that will be removed.

For a detailed list of all the steps, refer to this article by Intuit, or call your favorite ProAdvisor.

If you find that the Trial Balance has a huge discrepancy from the original Trial Balance, or if you are getting some goofy results, then it is time to call a specialist. I recommend Matt Clark, who is essentially a QuickBooks file doctor.

Good luck and always remember to make a backup before you start so that you can restore the file if the results are not what you expected!

by Jeanette

A winery owner asked me this question recently:

Jeanette –I have a question of the proper way to make a new entry. We purchased 220 cases of Sparkling wine from Rack & Riddle to sell under our brand.So, the initial entry into the system is for finished case goods 240 cases @ $108….given it’s not coming out of bulk…what is the proper entry?Thanks – Mark

The way that shiners are entered is fairly straightforward, however it depends on the situation (doesn’t it always…)

Scenario #1 – The shiners were labeled and finished by the vendor – this is super simple

Scenario #2 – You bought shiners, labels, and foils from different vendors and hired a crew or bottling line to apply the lables – this has a few more steps

For scenario #1

That’s it…just 2 steps. Of course, you will need to pay the bill at some point.

For scenario #2

The tricky part of this procedure is that you will be recording the components with a different workflow than usual. This may be confusing, but trust me…it is much simpler than including these bottles on the Bottling worksheet in the costing book.

Cheers!

by Jeanette

I am not a huge fan of QuickBooks Online, however for some situations, it is a good choice. Here is my list of the Pros and Cons to QBO for a winery:

I find that the best use for QBO is the small, startup winery where the owner is doing the bookkeeping, because you want to take advantage of as many automatic integrations as possible. You will need some method of processing credit card charges, and Square integrates nicely. However, Square is a short term solution, and as soon as you can justify a true winery program that will handle a Wine Club, you want to get that going so that you can start to capture details about your customers.

by Jeanette

On my recommended Chart of Accounts, the wine making costs are in the “Other Expense” section of the chart of accounts. These costs are really inventory costs, not expenses, but I put them there for two key reasons:

Before the end of the year, you will need to create a journal entry to transfer these amounts to the balance sheet. Some people will do this at the end of the month or at the end of the quarter, but the end of the year is fine because you can still use the Profit & Loss report.

I discuss this procedure in the Using QuickBooks in the Wine Industry course, but I don’t actually show how to do it. So here is the step-by-step video of how to enter that journal entry.

Cheers!

In this video (must be a Silver Club member to view) I will walk you through the steps. If you would like assistance, come to Office Hours or use this link to set up a coaching session.

Your first step to running a profitable winery and crushing your business goals.