This time of the year many of you are selling wine barrels to make room for new barrels. So what is the best way to handle this?

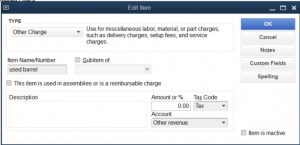

First, make an Other Charge type item and point it to a Misc Income account:

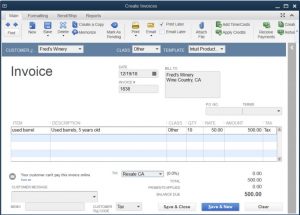

On your invoice, fill in the number of barrels and the cost per barrel. For the description, enter enough detail so that the barrels can be identified on the depreciation schedule. For example, “3-year-old barrels” or “2016 barrels”:

Here’s where things get tricky: if the barrels are sold to a winery they are not taxable because they are “ingredients” and are part of the thing they are selling. Or if they are sold to a woodworker who is fashioning it into something awesome so that the barrels are eventually sold (albeit in a different form), they are not taxable. In both these cases, your buyer has a resale number which you should collect for your records. (You are collecting these forms from all of your distributor and wholesale customers, right?)

However, if the barrels are sold to an individual to be used as a planter or something for themselves then it is taxable and needs to be counted as taxable sales on your sales tax return. It’s fine to sell the barrel as “tax included”. Just remember to not include the sale in your “sale to reseller” amount on your sales tax return.

Another detail is that the barrels need to be removed from the depreciation schedule. So be sure to let your CFO (or whoever calculates your costing) before the year-end is closed so that the right amount of depreciation is included in the costing. And, of course, let your tax preparer know so that the depreciation on the tax return is correct.

Coming Soon: How to pull the list of new fixed assets so you (or your tax preparer or CFO) can update the depreciation schedule.